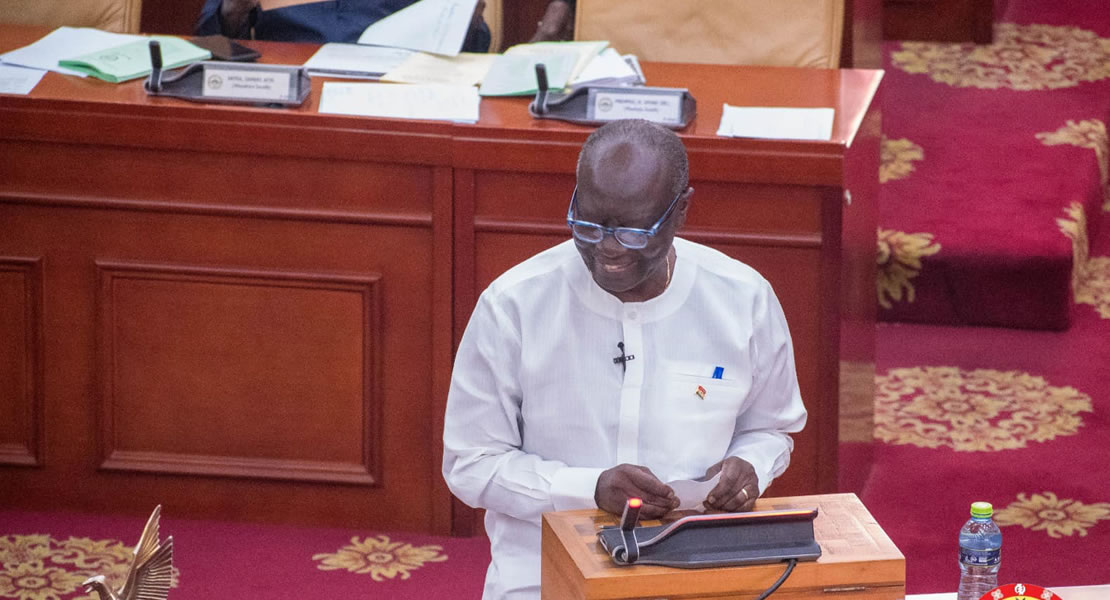

The Minister for Finance Ken Ofori Atta on Thursday, February 16, 2023 updated the Parliament on Ghana and people of Ghana on the Domestic Debt Exchange Programme (DDEP) which the Minority in Parliament has been pushing for.

According to him the aim of the programme is to alleviate the debt burden in a transparent, efficient and expedited manner, as they minimize its impact on investors holding government bonds.

According to him the aim of the programme is to alleviate the debt burden in a transparent, efficient and expedited manner, as they minimize its impact on investors holding government bonds.

“Mr. Speaker government is pleased to announce that as of February, 14 2023, approximately 85 percent of holders eligible to participate in the invitation for exchange as determined by the Central Securities Depository tendered in the Exchange”.

He said the current debt restructuring programme is occasioned largely by a series of external shocks that hit the country since 2020 as well as domestic factors.

And further told the House at the inception of negotiations with the IMF, it was agreed that Ghana would have to address its economic challenges on three fronts, embark on fiscal consolidation, undertake debt operations and secure financing assurance from development partners.

The Ministry has since December 5, 2022 seeking to restructure about GHc 137 billion worth of Government bonds and notes, as at December last year the total outstanding debt eligible and non-eligible holder amounted to approximately GHc 137 billion and subsequent extensions of the dates and payment of maturities meant that the remaining stock reduced from GHc 137 billion to GHc 130 billion.

The Ministry has since December 5, 2022 seeking to restructure about GHc 137 billion worth of Government bonds and notes, as at December last year the total outstanding debt eligible and non-eligible holder amounted to approximately GHc 137 billion and subsequent extensions of the dates and payment of maturities meant that the remaining stock reduced from GHc 137 billion to GHc 130 billion.

Mr. Ken Ofori Atta commended lawmakers for passing the 2023 budget statement and financial bills that accompanied it, and further noted that he is still counting on MPs for the passage of all outstanding revenue bills which are necessary for effective budget implementation as well as boosting Ghana’s effort at increasing Tax-to-GDP from less than 13 percent to the sub-Saharan average of 18 percent.

Government is relying on the Treasury Bills and concessional loans as the primary sources of financing for the 2023 fiscal year; therefore, the House should support Governments financing requests to ensure a smooth recovery from the economic challenges.

Kwaku Sakyi-Danso/Ghanamps.com