President John Dramani Mahama’s government has stayed true to the people of Ghana with several promises particularly abolishing of taxes.

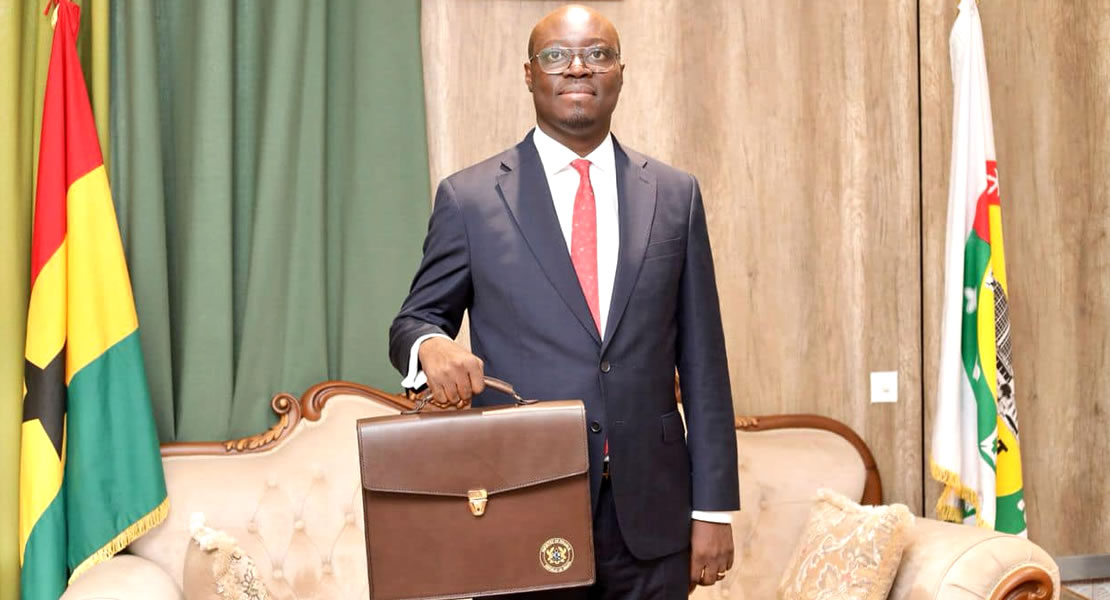

The Finance Minister, Cassiel Ato Forson in presenting the government’s 2025 Budget Statement and Fiscal Policy on Tuesday, March 11, 2025 in parliament announced that the government has “programmed the following nuisance taxes for removal in line with our manifesto promise”.

These include;

- we will abolish the 10% withholding tax on winnings from lottery, otherwise known as the “Betting Tax”;

- we will abolish the Electronic Transfer Levy (E-Levy) of 1%;

- we will abolish the Emission Levy on industries and vehicles;

- we will abolish the VAT on motor vehicle insurance policy; and

- we will abolish the 1.5% withholding tax on winning of unprocessed gold by small-scale miners.

The removal of these taxes, he stated, will ease the burden on households and improve their disposable incomes; and will support business growth and improve tax compliance.

Meanwhile, he has also announced comprehensive Value Added Tax (VAT) reforms this year to review the current distortions and cascading structure of the VAT regime.

“Ghana’s effective VAT rate is about 22 per cent. This is because GETFund Levy of 2.5 per cent, National Health Insurance Levy (NHIL) of 2.5 per cent and COVID-19 Levy of 1 percent are all added to the base for the final determination of the VAT rate of 15%.”

He said they have requested Technical Assistance from the Fiscal Affairs Department of IMF on VAT reforms and it is expected that the IMF Mission will commence in April 2025, adding that the recommendations from the Technical Assistance Mission will inform the VAT reforms.

Ahead of this, the finance minister said he will inaugurate a VAT Reform Task Force to hold broad consultation with key stakeholders for their inputs.

“Mr. Speaker, the parameters for the VAT reforms which will be completed this year will include:

- abolishing the COVID-19 Levy;

- reversing the decoupling of GETFund and NHIL from the VAT;

- reducing the effective VAT rate for households and busineses;

- reversing the VAT flat rate regime;

- upwardly adjusting the VAT registration threshold to exempt micro and small businesses from the collection of VAT; and

- improving compliance through public education and awareness.

Ghanamps.com