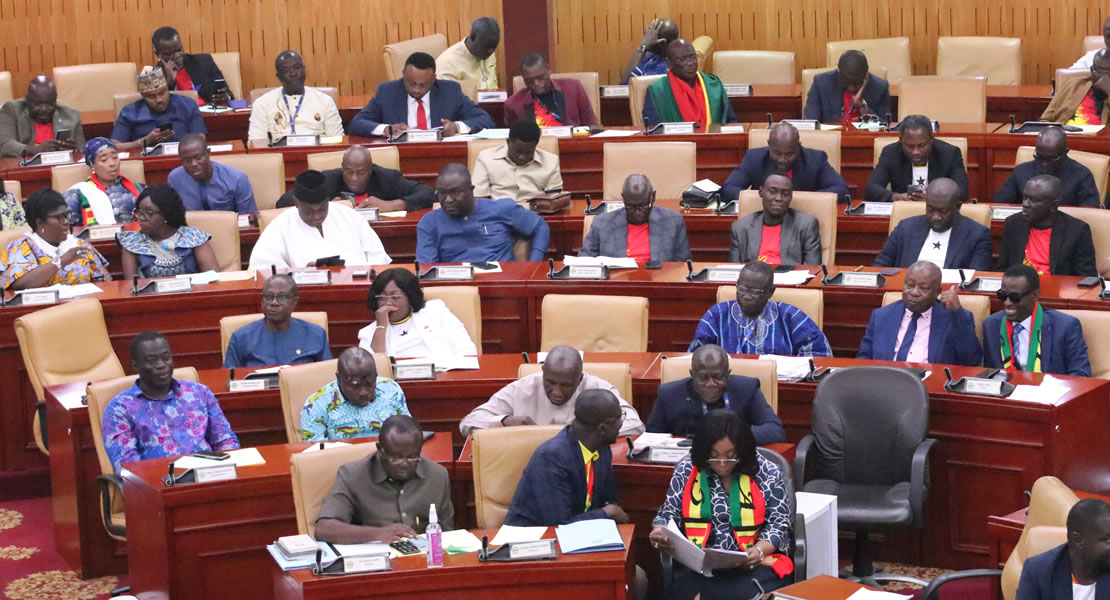

Finance Minister Ken Ofori Atta in presenting the 2023 budget statement on the floor of the House has hinted that government has received several proposals for the review of the Electronic Transfer Levy.

According to him they are working closely with all stakeholders to evaluate the impact of the Levy in order to decide on the next line of action which will include revision of the various exclusions.

As a first step, however, the headline rate will be reduced to one percent (1%) of the transaction value alongside the removal of the daily threshold.

As a first step, however, the headline rate will be reduced to one percent (1%) of the transaction value alongside the removal of the daily threshold.

And to this end, the income tax regime will undergo reforms to among others, review the upper limits for vehicle benefits and introduce an additional income tax bracket of 35%. 2023 BUDGET STATEMENT 20 Expenditure Measures.

Mr. Speaker, key expenditure measures will also be pursued to support the fiscal consolidation process.

Mr. Speaker, key expenditure measures will also be pursued to support the fiscal consolidation process.

In this regard, it is proposed that Government:

i. Reduce the threshold on earmarked funds from the current 25 percent of Tax Revenue to 17.5 percent of Tax Revenues;

ii. Migrate all earmarked funds onto the GIFMIS platforms and ensure they use the GIFMIS platform to process all their revenue and expenditures transactions. v. Continue with 30% cut in the salaries of the President, Vice President, Ministers, Deputy Ministers, MMDCEs, and political office holders including those in State-Owned Enterprises;

iii. vii. Place a cap on salary adjustment of SOEs to be lower than negotiated base pay increase on Single Spine Salary Structure for each year;

Mr. Speaker, Government has consistently indicated its intention to improve the revenue collection effort by leveraging technology to enhance tax administration, identify and register taxable persons and improve tax compliance.

Ghanamps.com