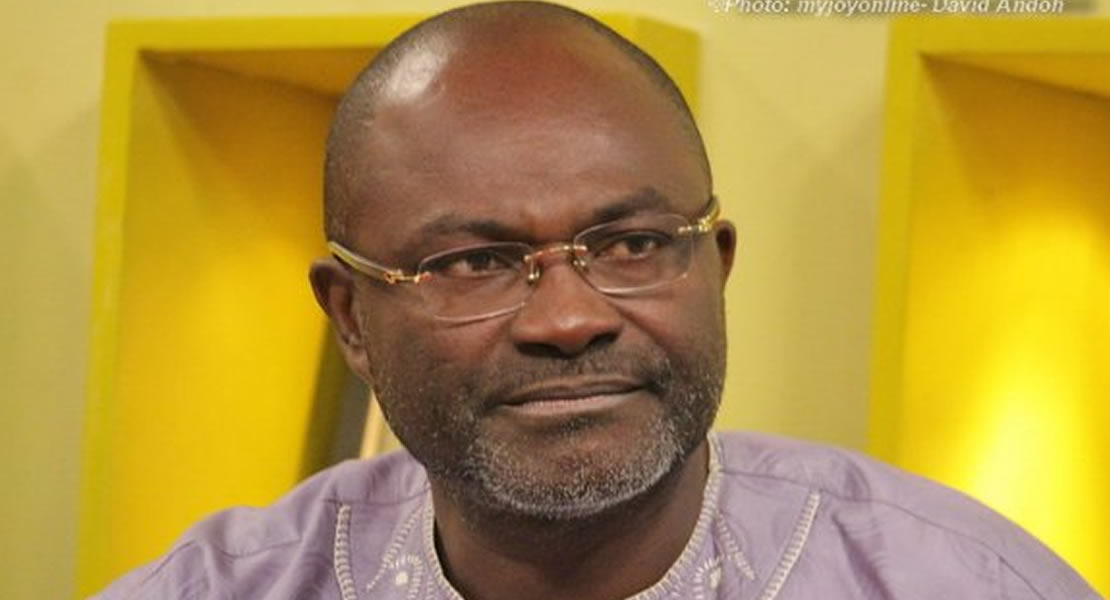

Member of Parliament for Assin Central, Kennedy Agyepong has said he would give President John Mahama a big salute if he goes beyond his decision to tax private institution but also tax the various churches across the country.

According to him, the churches are making huge incomes through their various business activities and it would not be out place for them to be taxed to help build the country.

The MP was speaking on Accra based Radio station Oman FM while commenting on the issue of government’s decision to impose a 25% corporate tax on private universities.

Until recently, private universities in Ghana were exempted from the payment of corporate tax in accordance with Section 10 (1d) of the Internal Revenue Act.

The Act exempts “income accruing to or derived by an exempt organization other than income from business”. Section 94 of Act 592 defined exempt organization as “religious, charitable or educational institution of a public character”.

However, the Internal Revenue Act (Act 592) was amended by Act 859 in May this year, with the aim of bringing private universities into the tax net.

There are currently 63 private colleges and universities, admitting 26 per cent of students who enter universities every year.

Hon. Kennedy Agyepong who backed the introduction of the tax said it was necessary as it was going to be charged on profits made by the universities.

He noted that though private universities are playing a significant role in improving the country’s educational sector, the economy is in a terrible state which requires support in the form of taxes from some institutions which hitherto were not taxed.

The MP who is an astute businessman averred that it is totally wrong for smaller companies who make meager profits to be taxed to develop the country, while other institutions which could be described as the big fishes are tax exempt.

Hon. Kennedy Agyepong said that it was prudent that the government widens the tax net to rope in more taxes, adding that the private universities make a lot of profits based on the huge fees they charge and must not be bothered to pay the corporate tax.

Kwadwo Anim/Ghanamps.gov.gh