The Minority New Patriotic Party (NPP) is skeptical about going to court at least for now to seek for redress in the country’s three year deal with the IMF which they claim has not received Parliamentary approval.

They have, however, cautioned that should their demand for Parliamentary approval of the bailout program fall on deaf ears, they will have no option than to turn to the Supreme Court.

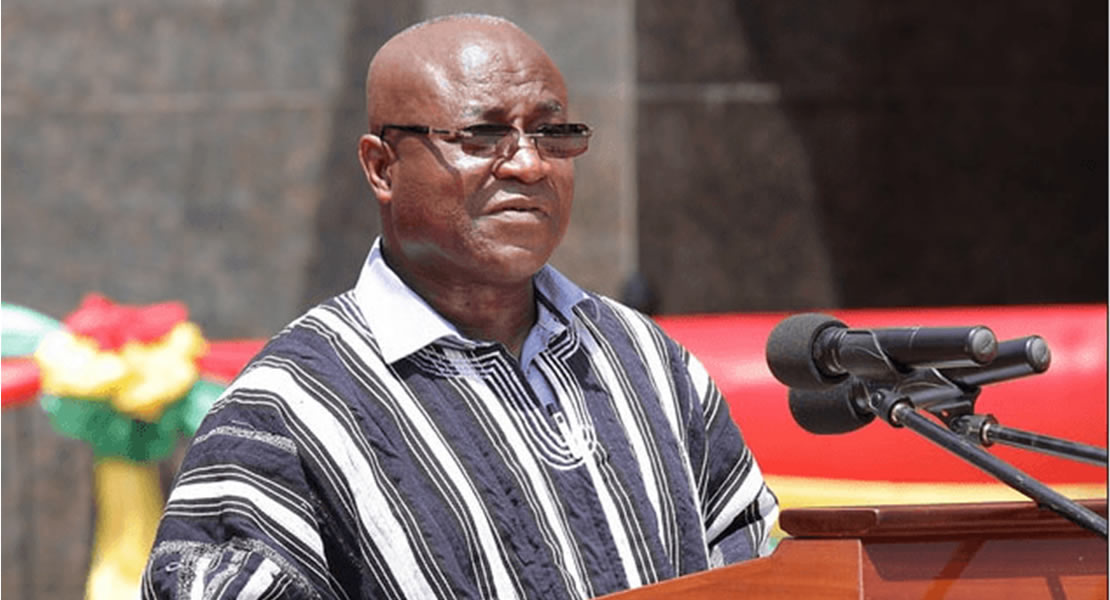

“For now we don’t think going to court is the best option that is why we have giving the government up till the end of September to let the Speaker recall Parliament for us to consider and approve the country’s US$918million Extended Credit Facility (ECF) deal with the IMF,” Dr. Anthony Akoto Osei, Ranking Member for Finance Committee said in an interview Monday.

He said once the government has enough space to decide on the case, there was no need to jump the boat.

His comments was in response to a statement by the Finance Ministry debunking claims by the Minority that the government has contravened Article 181 (3) (4) and (6) of the Constitution by failing to seek for Parliamentary approval for the IMF deal.

“The IMF loan to the Bank of Ghana does not constitute Government borrowing within the ambit of Article 181 of the Constitution. The borrowing would, therefore, not require Parliamentary approval under Article 181,” Cassiel Ato Forson, a deputy Minister of Finance, argued in a statement released in Accra on Thursday, September 10, 2015.

He added “Article 181 (3) of the Constitution provides that No loan shall be raised by the Government on behalf of itself or any other public institution or authority otherwise than by or under the authority of an Act of Parliament. The Act of Parliament that is relevant to Government borrowing and lending is the Loans Act, 1975 (Act 335). The Act of Parliament that is relevant to the Bank of Ghana’s operations is the Bank of Ghana Act, 2002 (Act 612), Section 51 of which clearly permits the Bank to borrow, even in some cases, without the prior approval of the Minister for Finance.

“It is worth noting that the IMF loan to the Bank of Ghana is not part of Government debt and the current Government debt levels exclude loans taken from the IMF. The IMF loan will not be serviced out of the Consolidated Fund or any other public fund, and therefore does not qualify to be a loan as defined in Article 181 (6) of the Constitution.”

But Dr. Akoto Osei argued in a counter statement that the IMF as an institution only lends to its member states and not the institution of its member states such as the Bank of Ghana as has been the practice since the country joined in the late 1950’s.

GhanaMPs.gov.gh