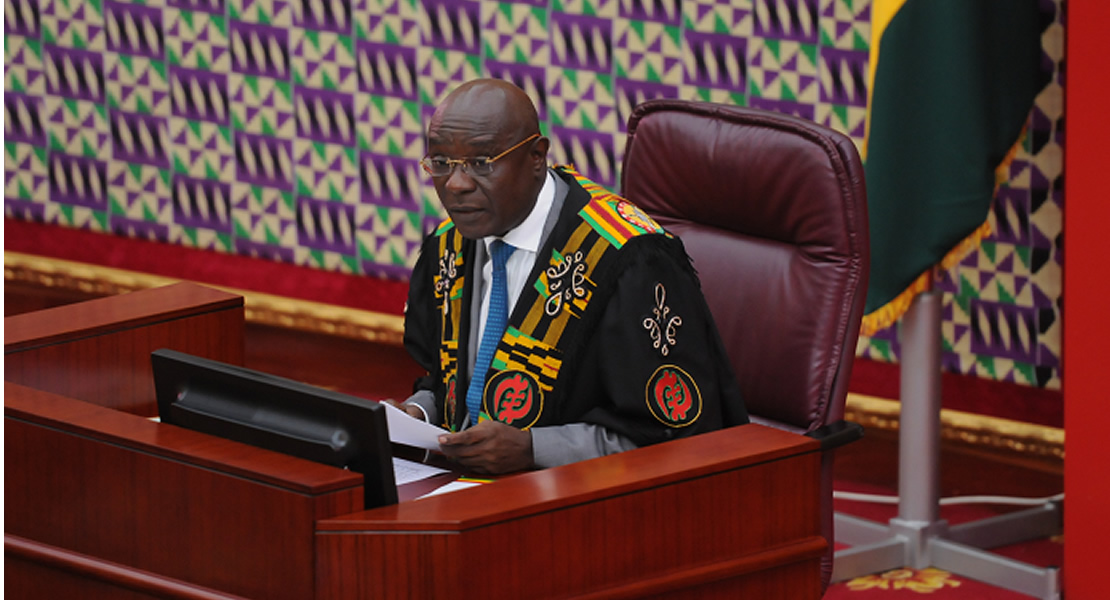

Parliament during the week passed a number of financial bills aimed at raking in more revenue into the national kitty.

One of the bills was the National Fiscal Stabilisation Levy (NFSL) Bill, 2013.

In an attempt to ensure fiscal stability, the government introduced the National Fiscal Stabilisation Act, 2009 (Act 785) in the second half of 2009 to raise funds for national development.

Act 785 was repealed in 2011 following the recovery/stability of the economy.

However, according to the Finance Minister, Mr Seth Terkper, the introduction of the Single Spine Salary Structure, among others, has led to budget overruns in many sectors of the economy.

Expenditure of the new salary structure also threatens to crowd out investment in critical sectors of the economy.

This has necessitated the re-introduction of the levy to help generate revenue to support shortfalls in the budget.

The re-introduction of the levy will last for 18 months and impose a five per cent levy on profit before tax of some specified companies and institutions.

Clause Five of the NFSL Bill mandates the Commissioner-General of the Ghana Revenue Agency (GRA) to prepare a provisional assessment in respect of the companies and institutions liable to pay the tax.

Commenting on why the rate was pegged at five per cent, Mr Terkper explained that though the government hoped to get more revenue through taxation, it was not its intention to overburden businesses with high taxes.

According to him, the economy is now recovering from the effects of the water and energy crisis and any higher tax rate is likely to adversely affect businesses and eventually slow down the recovery of the economy.

The Finance Committee of the House said in its report that even though it held the view that the proposed tax was generally not high, the government could generate more revenue if other traditional sources were explored.

It, therefore, called on the ministry to broaden the tax net to rope in other sectors of the economy.