The Minority members on the Finance Committee have urged government officials of the Akufo-Addo led administration who took huge sums of loans for their 2016 elections leading to the collapse of local banks to refund the money.

According to the Minority, they have information on the government officials of the current administration who had taken those huge sums of money and they should do the honorable thing.

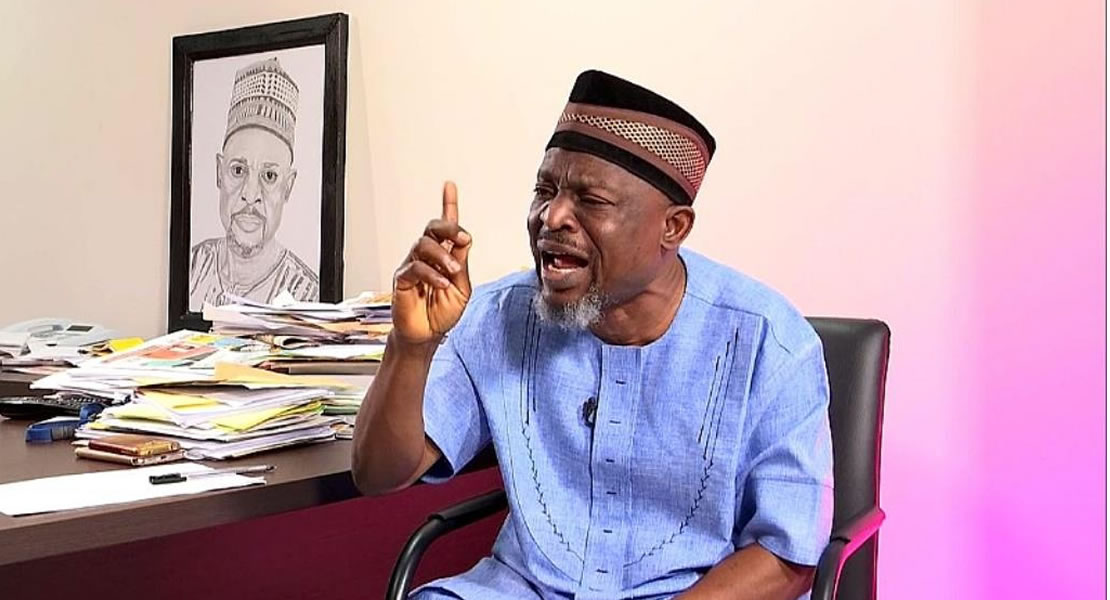

Monies should be paid back to the receiver so that depositors could be paid promptly, member of the Finance Committee, Isaac Adongo made this known at a press conference he address in Parliament House.

In a question and answer section, the Bolgatanga Central lawmaker told Ghanamps.com that it is not for the Minority to mention the names of the NPP officials, they should rather do the needful.

“At a point in time if the names would have to come out they would come out but it is not for us to put the names out; Ghanaians are struggling to come to terms with how the badly planned and poorly implementation of a minimum capital regime has virtually destroyed Ghana’s financial sector”, he lamented.

He further pointed out that, there are unanswered questions regarding how government spent twenty-three billion cedis of tax payers monies just to collapse financial institutions and create massive unemployment and turned entrepreneurs into idle hands.

The chaotic and often self-inflicting posturing of the Central Bank in handling the banking sector reforms showed a complete lack of directions and focus in the whole exercise.

Bank of Ghana (BOG) did not seem to have a clear strategic blueprint and implementation outcomes of the various elements of the financial sector. A basic question such as what type of financial system were they intended to achieve and the measurable indicators of implantation outcomes was not considered.

Savings and Loans Companies (S&L) did not know what to expect, except threats of collapse resulting in panic withdrawals. To date Rural and Community Banks who suffered unnecessary panic withdrawals sparked by the reckless comments of the Governor of the BOG do not know what to expect. Saving and Loans were collapsed before the issues of minimum capital and recovery plans were contemplated by the BOG.

The Ghanaian Tax Payer would have been spared the high cost of this chaotic reforms if BOG had listened and followed the reform program initiated by the National Democratic Congress (NDC) and the Governor had not been a needless talkative that caused panic and crushed confidence in the financial sector.

“Why would a government be ready to borrow GHc 14 billion to close down banks and further GHc 7 billion to shut Microfinance companies, but was not ready to use a fraction of this amount to pay off government debts to contractors, which largely accounted for the slide into insolvency in several cases of the collapsed banks?”

Kwaku Sakyi-Danso/ghanamps.com