Members of Parliament are advocating for insurance cover for farmers against losses of their farm produce due to effects of climate change.

The move, the MPs argued, is to encourage farmers to produce more to feed the country without bothering much about the losses they would incur in the event of extreme weather changes.

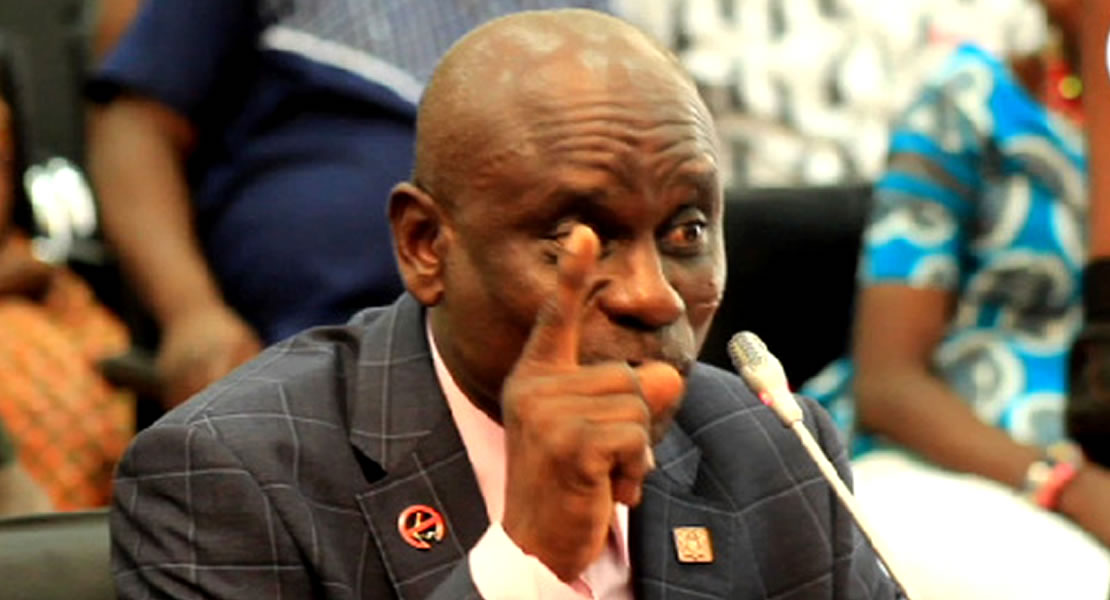

MP for Nsawam-Adoagyire, Frank Annoh-Dompire, who led the call proposed amendment to the Insurance Act, 2006, to include insurance for agriculture, especially, farmers and their farms as a measure to introduce some relief in their line of business.

“Mr. Speaker, insurance must be instituted to cater for our farmers with package intending to protect farmers, agro-processors, rural and financial institutions and input dealers among others in the event of failure due to extreme weather condition like drought, excess rainfall and floods”.

“I believe that protection from crop revenue losses in times of adverse weather events will enable farmers remain in production even after disasters”, he noted in statement delivered on the floor of Parliament, Thursday.

He added “with crop insurance cover, many farmers can have access to bank credit or input support. Agricultural insurance if introduced shall also provide protection for agricultural loan portfolios that is loans to clients involved in agricultural production. Thus, when clients suffer crop losses as a result of adverse weather condition, these institutions can cover their default with payouts from the insurance industry”.

MP for Mion and deputy Minister for Agriculture, Dr. Yakubu Alhassan contributing to the discussion said insurance for farmers and their produce is long overdue.

He recalled how lack of funding has inhibited an initiative the Ministry was pursuing to provide some relief to players in the agricultural sector.

“Insurance cover should not only be for cash crop. I think that livestock and poultry will also be a sector that should be covered because disease outbreaks we have witnessed in recent times. In many cases, when these outbreaks take place, the public purse will have to underwrite most of the losses that take place. I believe that if we have an institutionalized agricultural scheme, all these things would be absorbed by the company and the public purse would have been saved”.

“There are many insurance companies that are reluctant to come into agricultural insurance because of the risks associated with the weather, in particular, with re-insurance. Four years ago, the Ministry of Agricultural in collaboration with GIZ instituted what we call Ghana Agricultural Insurance Pool. This was a successor organization to GIZ collaborating with the Ministry of Agriculture to ensure that agricultural insurance was instituted within the country’s agricultural sector. The Agricultural Insurance Pool currently exists but there are challenges with funding”, he noted.

MP for Pusiga, Laadi Ayamba, contributed to the statement also stated that farmers do well to produce but in case of excessive rain or inadequate rain, the effect on them is unbearable.

Ms. Ayamba called for support to farmers by swiftly amending the “Act as soon as possible to make sure that farmers do not suffer enough in case of climate change.”